In early 2023, the LIONS team embarked on a mission to build a practitioner-focused value investing education program in China, modeled after the renowned program at our alma mater, Columbia Business School.

On September 23, 2023, after half a year of incubation, LIONS Academy launched its inaugural “Applied Value Investing” (AVI) class in Beijing. The class, grounded in CBS’s modern value investing approach, was tailored with contemporary content and local market nuances, drawing from our experience straddling the U.S. and China, across company building and investing. Emphasizing practical application and CBS-style class interaction, we invited seasoned fund managers and industry executives to join the case discussions and openly share their battlefield experiences. The feedback from students and guest speakers has been overwhelmingly positive.

The first cohort concluded with a special book signing session by Andrew Lin, CFA, CPA (CBS Value Investing Program alumni) and Dr. Shuai Fan (Peking University’s Value Investing class), the two translators of Professor Bruce Greenwald’s classic works “Competition Demystified” and “Value Investing: From Graham to Buffett and Beyond.”

(Highlight from the first Cohort, original voice in Chinese and translated into English using AI, with some awkwardness. “Shengshi” stands for “LIONS Academy”)

(Highlight from the second Cohort, no AI voice translation)

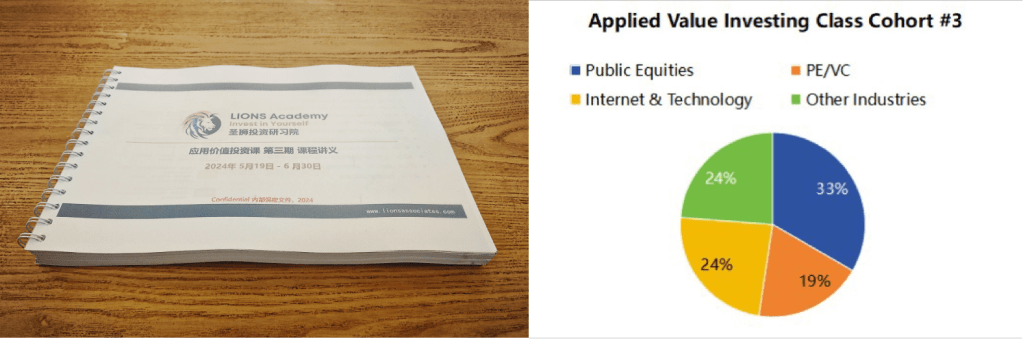

Fast forward to today, we are halfway through the third cohort of the class. The program has begun to spread via word-of-mouth within the investing and entrepreneurial community and has drawn over 100+ students from diverse backgrounds including hedge funds/mutual funds, PE/VC firms, family offices, start-ups, and professionals from technology firms and other sectors.

We are pleased to see the program gaining traction and honored to pass on the legacy inherited from the Columbia community, which traces back to almost 100 years ago.

Columbia’s Value Investing Program: A Century of Heritage and Evolution

The history began with Benjamin Graham and David Dodd, fathers of Value Investing. Their teachings at Columbia Business School since the 1920s laid the foundation and nurtured generations of outstanding value investors, including Warren Buffett, Todd Combs, Li Lu, Leon Cooperman, Mario Gabelli, etc. Today, Columbia’s Value Investing Program has evolved to a new era, offering over 20 courses taught by top fund managers and industry experts as adjunct professors. The Heilbrunn Center for Value Investing further connects students, professors, alumni, and practitioners via conferences and other events, fostering a community of investment wisdom.

One such event is the annual Pershing Square Challenge, sponsored by renowned investor Bill Ackman. The competition offers a prize pool of up to $150,000, providing an excellent platform for students to showcase their abilities and exchange ideas with top investment professionals. In 2017 and 2019, teams from China won the 1st place, demonstrating the strength of Chinese students on the international stage. Two members from the winning teams, Andrew Lin and Laurent Liu, also participated as guests in LIONS Academy’s classes.

(Left: 2017 winning team, YUM China; 2019 winning team, DollarRama)

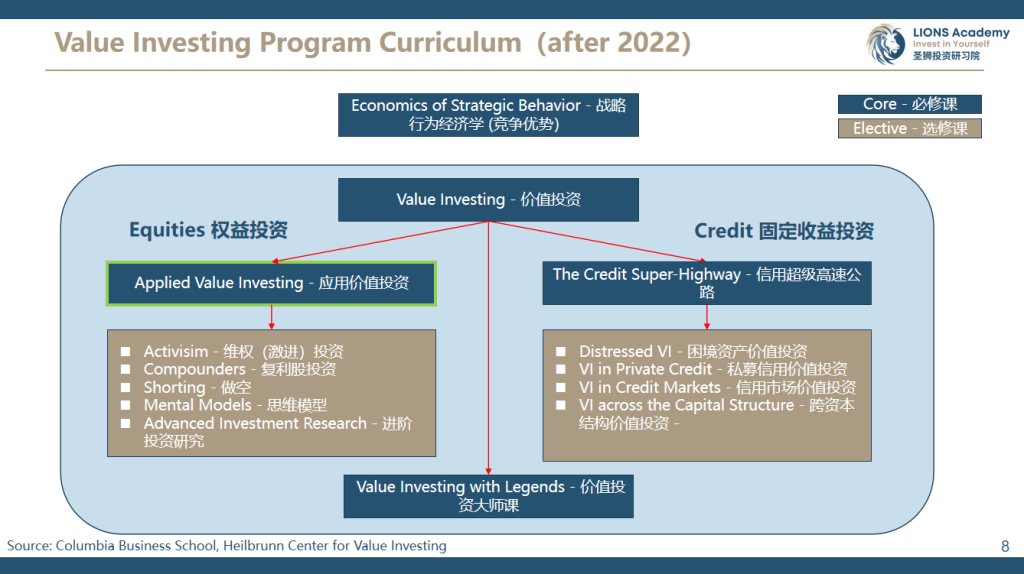

After 2022, the value investing program’s curriculum was refined to form two tracks: equity and credit investments. The two core courses, “Economics of Strategic Behavior” and “Value Investing,” are built around Professor Bruce Greenwald’s classic works “Competition Demystified” and “Value Investing,” laying a solid theoretical foundation for the program.

Under the new curriculum, “Applied Value Investing” is a critical advanced course that serves as the connecting tissue in the equity track. Each class is limited to 10 students per term and centered around in-depth case discussions under the guidance of adjunct professors and guest speakers. In the fall of 2014, LIONS co-founder had the privilege of being guided by Professor Andrew Gundlach (President of First Eagle, where George Soros began his career), Jean-Marie Eveillard (renowned value fund manager), and former Praxair CFO Jim Sawyer. Each class session invited renowned guests across investing and industry fields for in-depth and intimate sharing. The knowledge density and learnings have had a lasting impact on us, setting a high benchmark for LIONS Academy when we were developing the localized version of the course.

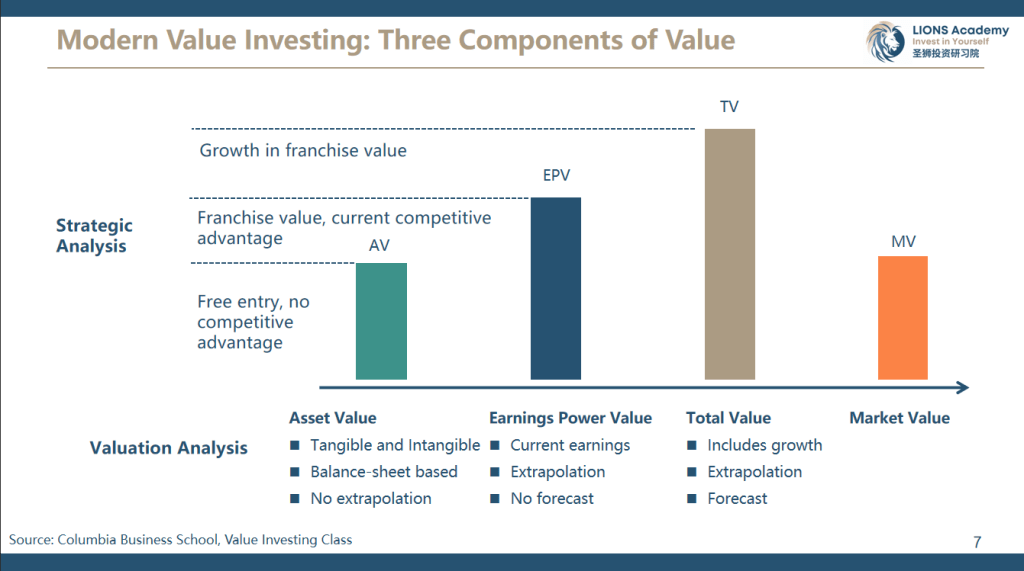

Today, value investing at Columbia has entered the 3.0 era. Columbia’s modern value investing approach breaks traditional stereotypes and encompasses the valuation framework for technology growth companies.

Value Investing 3.0: Assessing Growth and Intangible Assets

During Graham’s era, the world was predominantly industrial and physical, with a strong link between a company’s revenue and profits and the operations of its tangible assets. The “cigar butt” approach, which involved buying stocks at prices below their book value, was a value investing strategy that emerged during the Great Depression of the 1930s. This represented the value investing style of the 1.0 era.

In 1988, Buffett’s unexpected purchase of Coca-Cola stock stirred controversy among fundamentalist value investors who believed the price was too high. However, Buffett understood that GAAP accounting rules did not allow Coca-Cola to list its brand value and the value of its associated future cash flows on its balance sheet, making the company’s most valuable asset appear as zero. With Charlie Munger’s guidance, Buffett shifted away from the traditional value investing style of Graham’s era and began to focus on investing in high-quality companies.

After nearly a century of development, value investing is no longer confined to buying outdated or competitively disadvantaged companies at low P/E ratios. Pitting value investing against growth investing is also inaccurate. Buffett once said, “Growth is part of the value equation.” Buying excellent companies at an average price is as much a part of value investing as buying ordinary companies at a discount. When a company’s growth creates value (when the return on invested capital is greater than the cost of capital) and has a long run-way to deploy capital at attractive returns, investors should be willing to pay a slightly higher price for faster-growing companies, even though the market often gives premiums beyond what we can justify. This represented the value investing style of the 2.0 era.

Today, the world has shifted from an industrial economy to a digital/knowledge economy. Traditional accounting standards have not evolved to properly account for tech companies dominated by intangible assets. For tech companies, R&D investments, loyal customer bases, and scarce human talent (such as AI scientists and engineers) can be just as valuable as physical assets for brick-and-mortar companies. In this context, Columbia’s modern value investing approach has refined traditional methodologies to include the value of intangible assets, advancing the discipline to the 3.0 era.

Value Investing in China: LIONS Academy’s “Applied Value Investing” Course

To make the class more approachable to students in China, LIONS Academy innovated around the content, interactive format, and delivery structure of the class, retaining the classic framework and teaching methods of Columbia Business School while deeply integrating the local market environment and company characteristics. All case studies are contemporary and updated each quarter based on the latest developments of subject companies.

The current curriculum and case studies (subject to change) are:

Lecture 1 – Overview of Value Investing, Core Principles, and Investment Process & How Value Investing and Markets differ between the U.S. and China

Lecture 2 – Case Study: Fuyao Auto Glass (Manufacturing Industry)

Lecture 3 – Strategic Choices and Formation of Competitive Barriers – Building Capabilities before Moats

Lecture 4 – Case Study: Luckin Coffee (Consumer Discretionary and Turnaround)

Lecture 5 – Modern Value Investing and Valuation Approach

Lecture 6 – Challenges in Value Investing: Valuing Growth

Lecture 7 – Case Study: Pinduoduo/TEMU (Tech and hyper-growth company)

Lecture 8 – Corporate Governance and Management Analysis – Entrepreneurship with Chinese Characteristics

Lecture 9 – Value Investing in Cyclical Industries & Case Study: SinoTruck (Heavy Duty Truck)

Lecture 10 – Portfolio and Risk Management

Like an authentic Columbia classroom, the most valuable part of the course was not only the content but also the thought-provoking interactions and discussions among students and guest speakers. Each question sparked intellectual exchanges and practical insights. For LIONS, offering this course is both an opportunity to share knowledge and a process for continuous learning.

As beneficiaries of Columbia’s educational resources, we at LIONS aim to build a world-class program that contributes to the advancement of value-investing practices in China. In doing so, we not only seek to pass on knowledge and experience to practitioners eager to grow as fundamental-focused investors but also strive to establish LIONS Academy as a platform to foster two-way dialogues/learnings among investors in the East and the West in an increasingly divided world. After all, learning in Value Investing knows no borders.

Value investing is not just an investment discipline but also a philosophy of life. We are grateful for our early supporters, students, and guest speakers and look forward to joyfully learning, playing, and patiently building wealth with more like-minded partners in future courses.

P.S. For additional information in Chinese, please follow our official WeChat account “圣狮的伙伴们,” and Podcast “Skin in the Game.“